Key Takeaways:

Bitcoin’s self-custody declines as assets move into regulated ETFs.Institutional holdings surged 21% since spot ETF approval in 2024.

Retail investors reduced exposure, while traditional funds now control over 1.3M BTC

Bitcoin’s ownership map looks very different today than it did just a few years ago. Self-custody may be declining for the first time since the network’s creation. According to Uphold’s head of blockchain research, Martin Hiesboeck, large holders — or whales — move billions into regulated ETFs. They are drawn by new tax advantages and easier access to institutional services.

We analyzed the evolution of Bitcoin ownership between retail investors, whales, and entity-scale holders from 2020 to 2025, as well as structural changes following the approval of U.S. spot Bitcoin ETFs. Using data from CryptoQuant, and Dune, we categorize holders into three key segments:

Retail: Wallets holding less than 10 BTCWhales: Wallets holding between 10 and 1,000 BTC

Entity-scale wallets: Entities holding more than 1,000 BTC

Here’s how Bitcoin ownership is shifting — in charts.

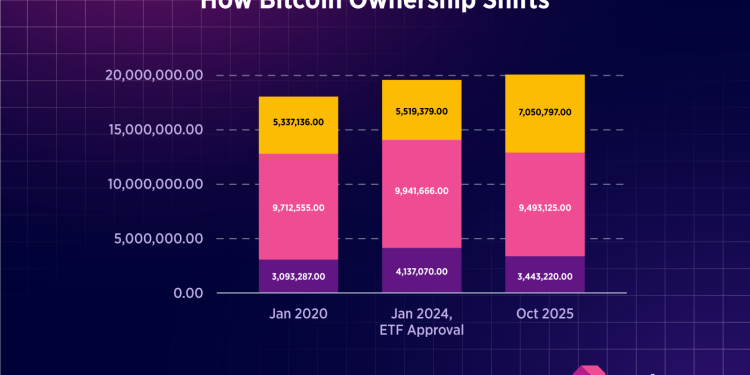

In 2020, large holders controlled most of the supply due to the much lower BTC price at the time. Retail holders collectively owned 3.1M BTC, or roughly 17% of the circulating supply, while mid- and large-scale wallets held around 9.7 million and 5.3 million BTC, respectively.

The approval of spot Bitcoin ETFs on January 10, 2024, marked the point when things began to change. Institutional investors gained regulated access to direct Bitcoin exposure, which led to substantial inflows into ETF products.

After the ETF launch, small holders began taking profits, while institutions accelerated accumulation through regulated investment vehicles. The growing adoption of BTC by large holders is further supported by rising demand from traditional institutions, with more than 1.34 million BTC flowing into U.S. spot ETFs.

Top Bitcoin ETF holders include:

Conclusion

What started as a network powered by individual holders is now increasingly dominated by large entities and institutional investors. The rise of spot Bitcoin ETFs has made it easier (and often more attractive) for big players to hold BTC through regulated channels. As self-custody declines for the first time in Bitcoin’s history, the asset is moving deeper into the traditional financial system. This is a sign of maturity for some, and a loss of its original spirit for others.

The post Bitcoin Ownership Distribution: How ETFs Shifted the Market appeared first on Cryptonews.

![[LIVE] Crypto News Today: Latest Updates for Nov. 28, 2025 – Crypto Market Stalls in Tight Range as Analyst Flags Bearish BTC On-Chain Signals](https://tradehavenhub.com/wp-content/uploads/2025/11/1764305311-nov-28-PGjH5O-120x86.jpg)